International Debt Collection Made Easy (Well, Easier)

Navigating the Global Debt Recovery Landscape

An international collection agency specializes in recovering outstanding debts across national borders, working with businesses to collect unpaid invoices from customers in foreign countries while navigating different legal systems, cultural norms, and language barriers.

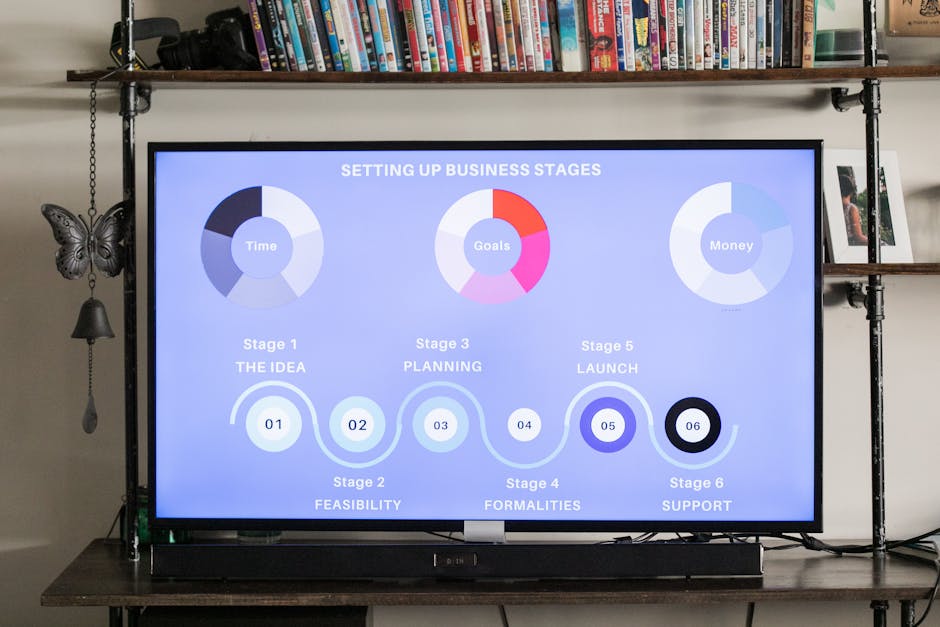

What is an International Collection Agency?

- A specialized debt collection service operating across multiple countries

- Employs multilingual staff familiar with local business practices

- Steers complex international legal frameworks and regulations

- Maintains networks of local representatives in various jurisdictions

- Works on contingency fee basis (typically 10-25% of recovered amount)

- Average success rate of 85% for viable commercial claims

When your business expands globally, so do your financial risks. Unpaid international invoices can quickly become a major cash flow problem, especially when you're dealing with debtors operating under unfamiliar legal systems thousands of miles away.

Unlike domestic debt collection, international recovery requires specialized knowledge of foreign legal systems, cultural nuances, and business practices. According to industry data, debts become significantly harder to collect once they cross borders, with success rates dropping by approximately 30% without proper expertise.

"Money knows no borders. Neither do we," as one leading international collection agency puts it – and this perfectly captures the essence of what these specialized services provide.

International collection agencies typically maintain networks spanning 100+ countries with on-the-ground representatives who understand local laws and customs. This local expertise is crucial, as attempting to apply domestic collection tactics internationally often leads to wasted time, resources, and ultimately, uncollected debts.

My name is Kevin Simon, and as a Senior Debt Collection Specialist with over 20 years of experience working with international collection agencies across the Middle East, North America, and Asia, I've personally witnessed how the right approach can transform seemingly uncollectible cross-border debts into recovered assets.

What Is an International Collection Agency and Why Do You Need One?

An international collection agency is a specialized company that helps businesses recover unpaid debts from customers in other countries. Unlike your typical domestic debt collector, these agencies have the right blend of expertise, resources, and local connections to handle global debt recovery smoothly—and save you from a world of headaches.

At Cosmopolite Debt Collection Agency, we've seen how businesses expanding internationally often underestimate just how tricky cross-border debt collection can be. The truth is, your homegrown debt recovery techniques might work wonders locally, but they rarely transfer well to international markets—often leading to frustration and, unfortunately, lost revenue.

As the International Association of Commercial Collectors points out: "When internal efforts to collect commercial debt prove unsuccessful, the most important next step you can take is to contact a member of an international collection agency with local expertise."

So why exactly do you need an international collection agency when chasing down foreign debts?

First, there's the issue of legal expertise. Each country has its own set of laws, enforcement mechanisms, and timelines for collecting debts (known as statutes of limitations). Our specialists at Cosmopolite, located across 17 global offices, know these local rules inside and out, giving you a massive advantage when navigating international legal waters.

Then there's the critical factor of cultural competence. Debt collection tactics that seem perfectly appropriate in North America can backfire dramatically in regions like Asia or the Middle East. For example, we once helped a Miami-based export company recover a large debt from a Turkish distributor. The company had almost given up after months of unsuccessful attempts, but our Istanbul team stepped in and recovered 95% of the debt—without damaging their valuable business relationship.

Let's not forget about language barriers. Effective debt recovery requires clear communication. Cosmopolite employs multilingual teams who ensure that nothing important gets "lost in translation," avoiding costly misunderstandings and increasing your chances of successful recovery.

Another powerful advantage is having a solid local presence. When debtors realize there's someone physically close by, ready and able to take action, they're far more likely to cooperate. It's psychological leverage that can't be underestimated.

Finally, an experienced agency can offer essential risk mitigation. International collections involve navigating political uncertainties, economic volatility, and regulatory complexities. An experienced partner can shield your business from these risks, protecting your cash flow and profitability.

The Growing Need for International Collection Agencies in a Global Economy

Today’s economy has dramatically reshaped how businesses operate. Even smaller companies are now reaching customers worldwide, thanks to digital technology. But with this exciting expansion comes an increased risk of cross-border payment issues. Businesses are finding (sometimes the hard way!) that international receivables management is a very different beast.

One major factor driving this trend is the globalization of small and medium enterprises (SMEs). While digital tools make it easy for SMEs to trade internationally, these businesses often lack the resources and specialized knowledge to manage international debt effectively. In fact, SMEs typically experience international payment delays about 40% more frequently than larger corporations.

Another key driver has been the recent pandemic-induced disruptions to global trade. Supply chain issues, border closures, and financial uncertainty have increased late payments and defaults. At Cosmopolite Debt Collection Agency, we've seen a 35% jump in international collection cases since 2020, especially from e-commerce businesses and service providers.

Economic instability is another critical factor. The past few years have brought currency devaluations, trade wars, and regional recessions—all of which fuel payment risks. And as supply chains grow increasingly complex, resolving payment problems across multiple partners and countries becomes even trickier, requiring specialized expertise.

Given these growing challenges and risks, partnering with a trusted international collection agency like Cosmopolite ensures you have the best possible chance of recovering your debts quickly and efficiently.

Key Challenges in International Debt Recovery

Recovering debts from overseas customers isn't as simple as sending a stern email or making a quick phone call. International debt collection comes loaded with unique challenges that domestic recovery simply doesn't face.

One major hurdle is legal jurisdiction complexities. Determining which country's laws apply to your debt can be tricky—it might depend on where the contract was signed, where goods or services were delivered, or even where the debtor's assets are located. Without international legal expertise, businesses quickly find themselves lost in a confusing maze of regulation.

Another common stumbling block is navigating cultural and business practice differences. Payment practices that seem problematic from your perspective might actually be normal elsewhere. For instance, extended payment terms are standard in some regions, while aggressive collection tactics common in North America can be seen as rude in places like Japan. Our Tokyo-based specialists once intervened for a client who almost destroyed a valuable distribution partnership by unintentionally causing offense. Happily, we were able to mend the relationship and secure payment.

Then there's the issue of documentation and proof. International collection agencies often need more rigorous documentation than domestic collection requires. Properly executed contracts, clear jurisdiction clauses, proof of international delivery, and accurate invoicing compliant with local regulations are all essential components for successful recovery.

Don't underestimate the impact of currency fluctuations, either. Delays in international payments can mean your original debt amount shifts dramatically due to exchange rates, potentially decreasing the debt's value when finally recovered.

Even if you secure a legal judgment, there's still the challenge of enforcement. While international treaties like the United Nations' New York Convention assist in recognizing and enforcing foreign judgments, actual enforcement requires local knowledge and connections—something a professional international collection agency like Cosmopolite maintains through its global network of partners.

Partnering with a trusted international collections expert not only boosts your chances of success—it protects your cash flow, mitigates risk, and helps preserve valued business relationships around the world.

How International Collection Agencies Steer Different Legal Systems

Debt collection is tricky enough when you're dealing with a debtor down the street. But add in multiple countries, languages, and legal systems, and things can quickly get overwhelming. That's where a specialized international collection agency can make all the difference.

At Cosmopolite Debt Collection Agency, we've built our expertise around steering the twists and turns of international debt recovery. Our global network spans 17 locations, each staffed with experts who have deep knowledge of their country's legal landscape. Trust us—when you're chasing unpaid invoices halfway around the world, local knowledge isn't just helpful, it's essential.

Legal systems differ dramatically across countries. Take Germany, for example—there, the debt collection process is highly structured, and certain statutory demands must be met before you can even begin court proceedings. Contrast that with the United Arab Emirates, where debt recovery often involves understanding both civil courts and Islamic Sharia law principles.

And then there's the United States, where collection regulations vary significantly from one state to the next. Some states require collectors to be fully licensed to operate commercially. Even within Europe, nuances exist—like in France, where specialized procedures such as the "injonction de payer" simplify and speed up judgments in certain situations.

No wonder one industry expert joked, "Collecting international debt can feel a little like playing chess blindfolded—unless you have someone who knows exactly how the game is played locally." Thankfully, that's exactly the expertise Cosmopolite provides.

When you bring Cosmopolite onboard, we kick things off with a thorough analysis custom to each specific case. Our approach includes carefully determining the correct jurisdiction for your debt—figuring out which country's laws actually apply. We conduct a detailed contract review, ensuring documentation is solid and enforceable under relevant laws.

Next, we identify the best legal pathways available for enforcement, carefully weighing the potential costs against likely recovery amounts. Finally, we develop a customized strategy designed to apply just the right pressure without damaging valuable business relationships.

Being part of the International Association of Commercial Collectors (IACC) network gives Cosmopolite access to trusted legal and debt recovery professionals worldwide. This extensive network ensures that wherever your debtor is located, we have a local expert available.

Understanding Local Debt Collection Laws and Regulations

Collecting a debt across borders isn't just about knowing general international practices—it's about mastering the tiny details of local collection laws and regulations.

Take data privacy, for instance. Regulations like the EU's General Data Protection Regulation (GDPR) have changed the game completely. Data privacy rules vary everywhere, and violations can lead to serious legal headaches and hefty fines. At Cosmopolite, we stay ahead of these requirements, ensuring compliance in every step we take.

Similarly, trade regulations can complicate recovery efforts. U.S.-based sanctions through the Office of Foreign Assets Control (OFAC), for example, restrict financial dealings with certain countries, companies, or individuals. Navigating these regulations isn't easy without specialized knowledge—and mistakes here can be costly.

Even seemingly basic issues like the statute of limitations—which determines how long debts remain collectible—vary greatly. In the UK, it's typically six years for most commercial debts, five years in France, and just three years in places like Germany and China.

Then there's documentation—never underestimate the power of proper paperwork! Some countries require contracts to be prepared and signed in the local language; others demand specific invoice formats or notarization. At Cosmopolite, our experts continually track these local rules, ensuring your documentation meets all requirements for efficient debt recovery.

The Role of Local Partners in International Debt Collection

In international debt collection, local expertise is the secret sauce. Even the most experienced international collectors might stumble without experienced on-the-ground partners who deeply understand the debtor's legal system, language, and culture.

At Cosmopolite Debt Collection Agency, we've invested significantly in building powerful relationships with local attorneys and specialized representatives in each of our 17 global locations. Why? Because the effectiveness of an international collection agency often hinges on the strength of its local network.

Local partners play a critical role as cultural mediators. They understand subtle cultural cues and can spot negotiation tactics unique to their region. They ensure we approach collections respectfully—avoiding unintentionally offensive missteps that could derail negotiations.

Our local attorneys and partners are deeply familiar with the intricacies of their local court systems. They know exactly what documents to file, which courts to approach, and what procedural problems to anticipate. Plus, their language expertise helps ensure no legal subtleties get lost in translation.

Another bonus of experienced local representation: relationship networks. The right local partner usually has connections within the courts, enforcement agencies, and even debtor communities. Those relationships can open doors and smooth processes in ways you'd never expect.

Here's a great example from our own experience: A U.S.-based software company was struggling to recover €75,000 from a French client. Although their contract was perfectly valid under U.S. law, it lacked certain specific clauses required by the French commercial code. Rather than launching into a risky legal battle, our Paris-based local partner spotted the issue immediately. They suggested mediation instead, and within weeks, the company recovered 85% of the debt—without stepping foot in court!

As debt recovery leaders like TCM Group emphasize, "The only way to ensure effective worldwide collections is through locally experienced, professional partners." At Cosmopolite, we couldn't agree more—our dedicated local partnerships are what help us recover your debts efficiently, preserve valuable business relationships, and keep your cash flow healthy.

The International Collection Agency Process: From Assessment to Recovery

When you're dealing with unpaid international invoices, understanding how the recovery process works can make all the difference between writing off a loss and getting paid. At Cosmopolite Debt Collection Agency, we've developed a structured yet adaptable approach that works across borders and cultures.

"Debt recovery success is achieved by focusing on diplomacy, persistence, and an understanding of individual and business circumstances," as one of our senior collectors often reminds our team. This philosophy guides everything we do, from the moment you hand over a case until the money hits your account.

Let me walk you through what happens when you partner with an international collection agency like ours.

Pre-Collection Assessment and Strategy Development

Before we make a single call or send a single email, we roll up our sleeves and dig into the details of your case. This foundation-building phase is critical to success.

First, we thoroughly review all your documentation. Contracts, invoices, delivery confirmations, emails, text messages – anything that establishes the debt is valid and the debtor acknowledged receiving your goods or services. I remember one case where a single email buried in a long thread made all the difference – the debtor had clearly written "invoice received, payment will be processed next week." That simple confirmation was the key to our eventual success.

Next, we analyze the debtor themselves. Are they still in business? Do they have assets? What's their payment history with other creditors? Have you had successful transactions with them before this issue? Understanding who we're dealing with shapes our entire approach.

Based on this information, we develop a realistic assessment of recovery probability. We won't promise you the moon – if a debtor has declared bankruptcy or disappeared completely, we'll be honest about the challenges. But we'll also identify opportunities others might miss, like pending business deals or hidden assets that could motivate payment.

Finally, we create a custom strategy just for your case. This isn't a one-size-fits-all process – a debt owed by a Japanese corporation requires a completely different approach than one owed by a Brazilian startup. We establish clear milestones, decision points, and communication protocols so you always know what's happening.

A client from Manchester recently told me how surprised they were by the depth of our assessment. "I thought you'd just start making calls right away," they said, "but your team really took the time to understand the situation. That made all the difference."

Amicable Collection Techniques in International Debt Recovery

While legal action gets all the drama in movies, the truth is that about 70% of our successful recoveries happen through amicable methods. This approach not only costs less but often preserves valuable business relationships.

The first contact is crucial. Our multilingual team reaches out in the debtor's native language, respecting local business customs while clearly communicating the seriousness of the situation. In Japan, this might mean a formal business meeting; in Brazil, perhaps a more relationship-focused phone call. Cultural understanding is essential – what works in New York could backfire in Dubai.

We also dig beneath the surface to find out why payment hasn't happened. Sometimes it's a genuine dispute about product quality. Other times, it's simply an invoice lost in an administrative shuffle. Cash flow challenges are common, especially for otherwise good customers who value your relationship. By identifying the real issue, we can address the actual barrier rather than fighting shadows.

Once we understand the situation, we can negotiate effectively. For disputes, we mediate solutions. For financial difficulties, we might arrange payment plans. For administrative confusion, we clarify and simplify. Throughout this process, we make payment as easy as possible – providing clear instructions, removing obstacles, and offering multiple payment methods.

I'll never forget a case involving a German manufacturer and their longtime Chinese distributor. The relationship had soured over an unpaid €85,000 invoice. Through careful conversation, we finded the real issue wasn't unwillingness to pay but a misunderstanding about product specifications that made the distributor feel they couldn't sell the goods. We facilitated a solution where the manufacturer provided additional components at a nominal cost, the distributor paid the original invoice, and their five-year relationship continued stronger than ever.

Legal Collection and Enforcement Across Borders

Sometimes, despite our best efforts, amicable approaches hit a wall. That's when having an international collection agency with legal expertise becomes invaluable. The transition from friendly to formal isn't one we make lightly – it involves careful consideration of costs, timelines, and enforcement possibilities.

Before recommending legal action, we conduct a thorough viability assessment. Is your documentation strong enough under the relevant legal system? Which jurisdiction makes the most sense for proceedings? Does the debtor have assets that can actually be seized if you win? What will the process cost compared to the potential recovery? These questions help us give you honest advice about whether legal action makes financial sense.

When legal proceedings are warranted, our network of attorneys across our 17 global locations springs into action. Often, just receiving a formal legal letter on an attorney's letterhead is enough to trigger payment. If not, we can file appropriate court documents, represent your interests, and pursue the case through to judgment.

But getting a judgment is often just the beginning of the enforcement journey. A court order in Country A may need to be recognized in Country B before any assets can be attached. Local enforcement procedures vary dramatically – what takes weeks in one country might take years in another. Our local partners steer these complexities while keeping you informed at every step.

In many international cases, arbitration or mediation offers a faster, more flexible alternative to traditional courts. These approaches can be particularly valuable when you hope to salvage the business relationship or when you need a resolution that courts can't provide.

A manufacturing client recently shared: "What impressed me most was how Cosmopolite didn't rush to legal action. They exhausted every amicable option first, saving us legal costs. But when we needed to get tough, they had the legal muscle ready to go in three different countries. We recovered 92% of a debt I'd completely written off."

The journey from assessment to recovery isn't always quick or simple when dealing with international debts. But with the right international collection agency guiding the process, even the most challenging cross-border debts can be transformed from write-offs to recovered assets. At Cosmopolite Debt Collection Agency, we've refined this approach across thousands of cases, combining global reach with local expertise to bring your money home.

Selecting the Right International Collection Agency for Your Business

Choosing the right international collection agency can feel like picking a travel buddy—get it right, and you'll enjoy a smooth journey to recovering your debts. Get it wrong, and you'll find yourself lost, frustrated, and possibly worse off financially.

That's why it's crucial to take your time and do your homework. With countless agencies claiming global capabilities, how do you separate those with true expertise from those simply making grand promises?

Essential Criteria for Evaluating International Collection Agencies

When evaluating potential international collection partners, there are several key points you'll definitely want to check off your list (and possibly underline twice):

First, consider their experience and track record. Ask how long they've been in business and how many international cases they've successfully resolved. At Cosmopolite Debt Collection Agency, we're proud of our track record with 20+ years of experience and a proven success rate of 95% for national and international collections.

Next, look closely at their global reach and local expertise. An agency might claim to handle collections everywhere, but do they truly understand the laws, culture, and business practices specific to your debtor's region? Cosmopolite operates in 17 key international markets, with dedicated local teams who know the ins and outs of each country's recovery processes.

It's also important to consider industry-specific experience. Collecting unpaid invoices from a telecom company in Asia requires a different approach than chasing a healthcare receivable in Europe. Make sure your chosen partner can demonstrate knowledge relevant to your specific industry.

When it comes to international debt collection, language is a critical factor. Check if the agency has multilingual capabilities—native speakers familiar with legal and business terminology. Clear communication with your debtor can be the difference between successful recovery and a costly misunderstanding.

Next, investigate their technological infrastructure. Today's best agencies provide secure online portals for easy case tracking, automated reporting, and digital documentation management. Cosmopolite, for example, offers client-friendly platforms designed for transparency and convenience.

You'll also want reassurance of their compliance and certifications. Reliable international collection agencies will hold memberships with respected organizations like the International Association of Commercial Collectors (IACC). They should comply fully with GDPR, OFAC, and all relevant international regulations to protect your interests.

Finally, don't forget to ask for client references and testimonials. Reading reviews by people who've already walked the international debt recovery path can give you confidence in your choice. At Cosmopolite, we're proud to have earned a 4.52/5 rating from over 16,827 happy clients.

Fee Structures and Payment Models in International Debt Collection

Understanding fee structures is another critical factor when evaluating an international collection agency. Let's unpack the most common payment models:

Contingency fees are very popular, and for good reason—they mean you only pay if the agency successfully collects funds. Typically, contingency fees range from 10% to 25% of the collected amount, depending on complexity and age of debt. Cosmopolite Debt Collection Agency offers clear and competitive contingency rates, so you always know what to expect.

Flat fee arrangements might make sense in some situations, especially when collection odds are high or if you're dealing with a large volume of predictable cases. You pay a fixed amount regardless of outcome, offering budget certainty but less alignment in incentives.

Hybrid models balance the risks and rewards more evenly between you and the agency. This might involve a modest upfront fee combined with a lower contingency percentage upon successful recovery. These models are becoming increasingly popular for complex or mid-level difficulty cases.

Whichever option you choose, make sure to clarify any additional potential costs upfront, including legal fees, court filings, translations, and currency conversion expenses.

As one of our favorite sayings goes, "Clearly the largest collection agencies can't always have debt collectors with this level of experience and ability." When comparing fees, it's less about choosing the lowest percentage and more about the total value and net results you'll receive.

At Cosmopolite Debt Collection Agency, we understand that selecting your global debt recovery partner isn't a choice you can afford to get wrong. Our dedicated teams combine local knowledge, global expertise, and genuine care for client outcomes—ensuring you can rest easy knowing your international receivables are in safe hands.

Technology and Innovation in International Debt Collection

Technology has reshaped nearly every aspect of how an international collection agency operates—and at Cosmopolite Debt Collection Agency, we're embracing those changes wholeheartedly. From faster recoveries to smoother communications, technology hasn't just made our jobs easier—it's made them far more effective, too.

Let's explore exactly how innovative tech tools are changing cross-border debt recovery and why that matters to your business.

How Technology Improves Cross-Border Debt Recovery

When you're chasing payments across countries and time zones, traditional methods can quickly become overwhelming. Enter modern tech solutions, which handle complexity effortlessly, bringing clarity, efficiency, and results.

At Cosmopolite Debt Collection Agency, we use AI-powered analytics to quickly assess each debt scenario. These predictive models look at debtor profiles, jurisdictions, debt characteristics, and payment histories—helping us accurately predict recovery outcomes and decide the best course of action. It’s like having a crystal ball, only much more reliable.

Another game changer is blockchain technology. Highly secure and tamper-proof, blockchain provides a trustworthy record of debt-related documentation across borders. This ensures that important contracts, invoices, and proof-of-delivery documents remain safe, authentic, and easily accessible—even in jurisdictions where documentation fraud can be an issue.

Behind the scenes, our team stays coordinated through cloud-based case management platforms. With all information centralized and updated in real-time, our specialists in Dubai, Paris, or New York can effortlessly collaborate and seamlessly share information without missing a beat—no matter the time zone.

On the debtor side, digital communication platforms offer secure, compliant, and culturally-sensitive ways to engage. These technologies allow us to maintain detailed audit trails and comply with local communication regulations, all while keeping interactions professional, effective, and respectful.

Thanks to technology, geography is becoming less of a hurdle. As one seasoned collection professional joked, "Debtors never know if we're calling from next door or across the ocean; they just know we're staying in touch!"

Data Security and Privacy in International Collections

Of course, technology isn't just about efficiency—it's also about trust. Protecting sensitive financial and personal data isn't just good sense—it's the law.

Today, international debt collectors have to steer an ever-changing landscape of data protection regulations, such as Europe's General Data Protection Regulation (GDPR), California's Consumer Privacy Act (CCPA), Brazil's General Data Protection Law (LGPD), and Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA). At Cosmopolite, we rigorously follow these frameworks, ensuring compliance in every jurisdiction we serve.

Our approach to data security is layered and robust. We implement end-to-end encryption for all sensitive data transfers—think of it as your information locked safely in a digital vault during its journey. We also employ secure cloud storage with geographic backups, strict access controls, and regular cybersecurity audits to identify vulnerabilities early.

Another key element is adhering to data minimization principles, meaning we collect only what's absolutely necessary, keep it for just as long as needed, and securely delete it afterward. We also provide clear privacy policies and consent management tools, making sure debtors and clients alike feel confident that their rights are respected.

In fact, one of our healthcare clients specifically chose Cosmopolite Debt Collection Agency because we maintain HIPAA-compliant standards across borders—a must-have for managing their sensitive patient billing operations around the world.

At Cosmopolite Debt Collection Agency, technology isn't just another tool in our toolkit—it's the foundation for faster recoveries, smoother communication, and secure operations worldwide. With innovative solutions at our fingertips, we're not just chasing debts—we're redefining how international debt collection can and should be done in the digital age.

Frequently Asked Questions about International Collection Agencies

What is the Success Rate of International Collection Agencies?

Ah, the million-dollar question—literally! The success rate for an international collection agency can vary quite a bit, depending on several key factors. Let's break it down clearly:

The biggest factor by far is how long the debt has gone unpaid. Not surprisingly, fresher debts (under 90 days overdue) have the highest recovery success—typically around 80-90%. But as debts age, your chances of seeing that money again start to drop faster than your motivation on a Friday afternoon. After 6 months, recovery rates usually hover around 50-70%, and after a full year, they plummet further to 30-50%. Debts over two years old? Well, let's just say they're about as easy to collect as compliments from a teenager—below 30%.

The type of industry also matters. Manufacturing and wholesale businesses usually see higher recovery success rates (75-85%), thanks to clear contracts and documentation. Service and consulting debts also have solid recovery rates (65-80%). Construction debts can be trickier, with a wider spread (50-75%), while international consumer debts often have lower recovery rates, hovering around 40-60%.

Documentation quality is another game changer. At Cosmopolite Debt Collection Agency, we've found that properly documented claims—think clear contracts, signed delivery confirmations, and documented correspondence—can help you achieve a roughly 30% higher recovery rate than poorly documented claims. So do your future self a favor and keep those documents tidy!

Your debtor's location can also significantly impact your chances. Debts originating in regions like North America and Western Europe typically have higher success rates, while Eastern Europe and Latin America fall somewhere in the middle. The Middle East and Asia can be more variable; some countries are easier, others not so much. Africa, unfortunately, tends to present some of the greatest challenges, with generally lower recovery rates.

Finally, the expertise of your chosen international collection agency can make or break your recovery chances. At Cosmopolite, we're proud to maintain an impressive 95% success rate for viable claims—significantly above industry averages. Our global reach in 17 strategic countries, together with our proven negotiation and legal strategies, makes a real difference. (Not to brag, but we kind of rock at this.)

How Do International Collection Agencies Handle Language and Cultural Barriers?

International debt recovery isn't just about knowing the laws—it's also about knowing the local language, customs, and etiquette. At Cosmopolite Debt Collection Agency, we don't just speak "collections," we speak practically every language you can think of.

First, we employ multilingual professionals who are fluent in the local language and understand the subtleties of regional business practices. These aren't just translators—they're your empathy experts, trained to listen and communicate respectfully while advocating effectively for your unpaid receivables.

But language itself is only half the battle. Our teams receive ongoing cultural intelligence training, helping them tailor their communication styles for each region. For example, some cultures prefer direct and formal communication, while others expect gentle, relationship-based negotiation. Knowing these nuances is crucial—otherwise, you may unintentionally offend someone and lose any hope of getting paid. (Trust us, nothing kills your chances quicker than accidentally insulting someone's grandmother on a call.)

Our local representatives are another secret weapon. They live and work in the debtor's community, building relationships and understanding the local business environment. Often, a friendly in-person visit or culturally sensitive conversation can clear up misunderstandings faster—and more effectively—than any stern letter from overseas.

One quick example: Our Bangkok office once helped a European manufacturer recover debts from a Thai distributor. Rather than using confrontational language like "overdue," our local representative suggested phrasing it around "payment scheduling." The debtor was able to save face, and we arranged a mutually respectful payment plan. Win-win!

What Timeframe Should I Expect for International Debt Recovery?

Ah, timeframes—another tricky one. Unfortunately, there's no one-size-fits-all answer when it comes to recovering debts from international clients. But let's unpack it to give you a realistic idea of what to expect.

The quickest route is always through amicable collection (that's a fancy way of saying friendly negotiation). At Cosmopolite, we find most cases resolved through amicable collection typically wrap up within 30-90 days. If initial negotiations don't produce results, pre-legal notices can add another 15-30 days.

But if things escalate to legal proceedings, recovery times can stretch out significantly. Some countries, like Germany, have relatively efficient legal systems, often yielding judgments within 3-6 months. Other nations are slower—Italy, for example, is notoriously lengthy, sometimes taking upwards of two years. In the UAE or the USA, timelines hover around 6-12 months, depending on the complexity.

The debtor's cooperation level is another big factor. A willing debtor who engages positively and agrees to a payment plan can result in payments within 30-60 days. Disputed claims typically require more back-and-forth negotiation, extending the timeframe to around 60-120 days. Uncooperative debtors? Well, prepare to be patient; legal action will almost certainly extend the recovery period significantly.

Finally, the complexity of your claim matters—straightforward invoices get resolved faster, while complex contractual disputes or debts involving multiple jurisdictions inevitably take longer.

At Cosmopolite, we'll always provide you with a realistic timeline based on our experience in each region. No unrealistic promises, just clear communication and transparency throughout the process. After all, nobody likes being left in the dark—especially when money is involved!

In the words of one happy client: "Cosmopolite Debt Collection Agency has done an excellent job for us—especially with international collections. They have multilingual staff and work our accounts thoroughly before recommending legal action." And that's exactly how we'll work for you, too.

For even more insights, check out our resources on How to Collect an International Debt and Global Solutions Debt Collector.

Conclusion

Collecting debts internationally presents unique challenges for businesses—challenges that go beyond just geography. Navigating diverse legal systems, overcoming language and cultural barriers, and handling complex regulations all require specialized skills and experience. And that's exactly why having a trusted international collection agency by your side makes an enormous difference.

At Cosmopolite Debt Collection Agency, we've dedicated ourselves to making global debt collection simpler, faster, and more effective. With offices in 17 strategic locations worldwide, we're able to combine global reach with deep local knowledge. Our highly-rated professional service (4.52/5 from over 16,827 reviews) has earned us a reputation for turning seemingly impossible cross-border receivables into recovered revenue—all while preserving valuable business relationships.

If there's one thing we've learned over our 20+ years in the business, it's this: the sooner you tackle international debt recovery, the better. Recovery rates drop dramatically the longer debts remain uncollected, making swift action essential.

Partnering with the right collection agency is crucial. It's not enough for an agency to claim "global coverage"—you need one with proven expertise in your debtor's specific region and industry. At Cosmopolite, we offer exactly that combination, along with local representatives who understand the cultural nuances and business norms. After all, recovering debts effectively isn't just about getting your money back—it's also about protecting your valuable international relationships.

In today’s digital world, successful international debt recovery also relies on smart technology. Cosmopolite leverages advanced tools such as AI-driven analytics, blockchain-secured documentation, and cloud-based case management systems. These innovations allow us to communicate more effectively, work faster across borders, and provide transparent progress updates to clients.

Proactivity also goes a long way. By keeping clear documentation, setting up contracts with strong jurisdiction clauses, and spotting payment issues early, you strengthen your position when collection becomes necessary.

One of our favorite client testimonials sums it up best:

"We struggled for quite some time to find a collections agency that was strong in international collections, but Cosmopolite is very well versed in business climates and country regulations. They have assisted in recovering receivable balances we believed were dead in the water."

Effective international debt collection isn’t just about collecting cash—it's about managing financial risks, protecting your cash flow, and preserving business relationships that took years to build.

At Cosmopolite Debt Collection Agency, we make international debt recovery easier—not exactly a fun afternoon at the beach, but certainly less stressful.

Ready to turn your unpaid international receivables into recovered revenue? To learn more about how we can support your business's global growth, visit our International Debt Collection Agency page today.