The Art of Corporate Debt Recovery Without Losing Your Mind

Why Corporate Debt Recovery is Crucial for Your Business

Corporate debt recovery is the process businesses use to collect overdue payments from other companies. It involves structured steps—ranging from sending polite reminders and formal demand letters, to legal actions when needed—to recover unpaid debts and maintain healthy cash flow.

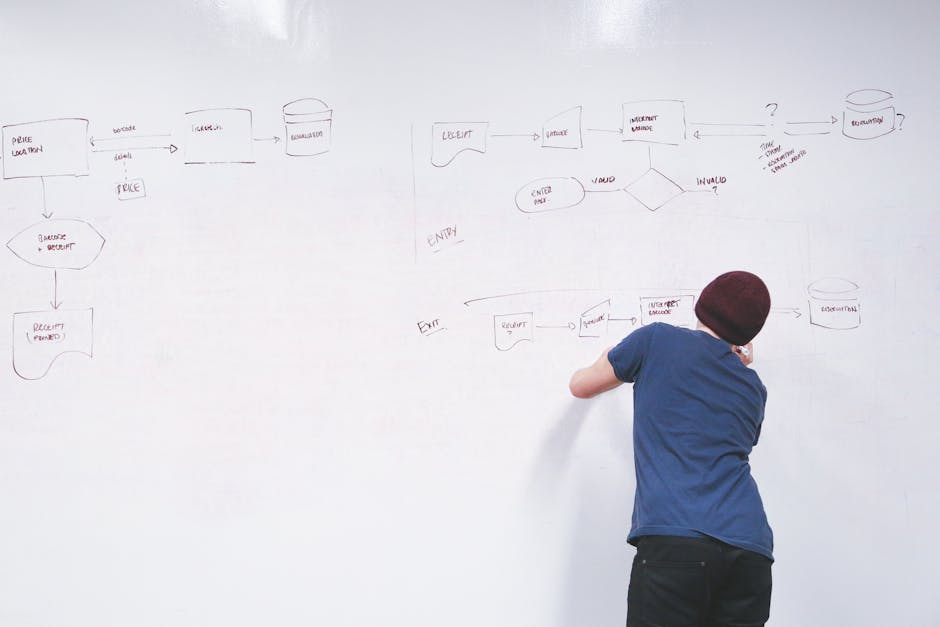

Here's a quick summary of what corporate debt recovery involves:

- Initial Communication: Sending reminders via letters or phone calls.

- Formal Demand: Issuing formal letters clearly stating payment terms.

- Legal Proceedings: Taking court action if amicable methods fail.

- Enforcement: Using legal enforcement measures after court judgments.

Unpaid invoices aren't just frustrating—they directly hurt your business, slowing your cash flow and limiting your ability to grow. As someone who's been solving these issues for over two decades, I know that effective corporate debt recovery is not just about getting paid; it's about keeping your business relationships intact.

I'm Kevin Simon, and over the last 20 years, I've helped global companies successfully handle corporate debt recovery across North America, Asia, and the Middle East. In this guide, I'll share exactly how to reclaim what's owed without losing your peace of mind—or your clients.

Simple corporate debt recovery glossary:

Understanding Corporate Debt Recovery

In today's tough economy, a big challenge businesses face is dealing with unpaid invoices from other companies. According to debt recovery specialists, The Kaplan Group, there's an 85% success rate in recovering large viable debts—showing that corporate debt recovery isn't just common, it's manageable with the right approach.

But what does this mean, practically speaking? Every unpaid invoice isn't just about a missing payment in your books. It's money you've already spent on materials, labor, time, and effort. Money you counted on to keep your business healthy, pay your staff, or invest in growth. When payments are delayed or never come, it hurts more than just your bottom line—it impacts the overall health of your business.

Debt recovery expert Dean Kaplan points out, "The chances of collecting on an invoice due from a company that's gone out of business are very slim." In other words, the quicker you act, the better your chances of getting paid. Speed matters!

So, let's dig deeper into exactly what corporate debt recovery is and why it's so critical for businesses.

What is Corporate Debt Recovery?

At its heart, corporate debt recovery is the process businesses use to collect overdue payments from other companies. It's about reclaiming your unpaid invoices, loans, or bills that have been ignored or delayed.

Think of it this way: You've provided products or services in good faith, or perhaps you've loaned money or credit to another company. Maybe you've even experienced breaches of contract or delayed payments. Corporate debt recovery is the structured approach you take to recover those outstanding amounts and protect your cash flow.

Corporate debt recovery focuses exclusively on business-to-business (B2B) transactions. This makes it quite different from consumer debt collection, as B2B dealings come with their own rules, legal frameworks, and best practices.

Why Corporate Debt Recovery is Essential

Unpaid invoices aren't just an annoyance—they can genuinely threaten the financial stability of your business.

When invoices go unpaid, your cash flow takes an immediate hit. That means less money for day-to-day operations, payroll, and investments. A disrupted cash flow can quickly turn into a stressful domino effect—you start struggling to pay your own bills, suppliers, and employees.

What's more, capital that's tied up in unpaid invoices can't be used to replenish inventory. Your inventory turnover slows down, and before you know it, your shelves are empty, and you're unable to meet new demands, causing even more lost revenue.

Additionally, a high amount of overdue receivables can damage your company's credit rating. A weaker business credit score means difficulty getting favorable loans or credit terms in the future—making growth and expansion challenging.

And speaking of growth, unpaid debts mean fewer resources for innovation, hiring new talent, or entering new markets. You're forced to waste valuable time and energy chasing payments instead of focusing on what you do best—running and growing your business.

Finally, let's not underestimate the emotional toll. Chasing debts can be exhausting and stressful for business owners and managers alike. It's distracting and draining, pulling your attention away from other critical areas of your business.

As one wise debt recovery agency put it humorously, "The lack of money is the root of most evil!" The good news is, with an effective corporate debt recovery process, you can avoid bankruptcy, maintain profitability, and keep your business thriving.

Ready to dive deeper into how to manage your business debts effectively? Check out our guide on What is Commercial Debt Recovery. For more industry insights, the Association of Credit and Collection Professionals offers valuable resources on best practices in debt recovery.

The Corporate Debt Recovery Process Step by Step

Navigating corporate debt recovery effectively is all about following a clear, structured process—one that we've honed at Cosmopolite Debt Collection Agency through thousands of successful recoveries worldwide. But don't worry, it's not rocket science (though sometimes it might feel like it!).

Let's break down exactly how the process unfolds, step by step, so there are no surprises and you know exactly what to expect.

Initial Communication and Reminders

The first stage of corporate debt recovery is all about friendly but firm communication. After all, we want to collect the debt—not end the relationship!

As soon as your invoice becomes overdue, it's time for an immediate gentle reminder. This often takes the form of a quick, polite email or phone call, simply checking if the invoice was received and reminding the debtor that it's now past due.

If after about a week there's still no payment, we move to a follow-up reminder. This time it's slightly firmer and more direct—usually a phone call, since hearing a human voice tends to encourage quicker responses. Phone calls are consistently rated the most effective business debt collection technique at this stage.

We continue with regular follow-ups, always maintaining professionalism and respect. At Cosmopolite, we've noticed roughly 40% of overdue payments are resolved during these early stages, often because the debtor simply overlooked the invoice, misplaced it, or made a small administrative error.

During these conversations, we'll also double-check important details like making sure invoices were sent to the correct person, verifying addresses, and ensuring all contractual obligations were met. We carefully document every interaction so we can reference it clearly if the issue escalates.

Formal Demand Letters

If friendly reminders aren't getting the job done (and it happens!), the next step in our corporate debt recovery process is sending a formal demand letter—often known as the Letter Before Action (LBA).

This is a strongly-worded letter that clearly outlines the debt's details, such as invoice numbers, dates, and overdue amounts. It also references previous communications, giving your debtor a full picture of the situation.

Crucially, the LBA will clearly state the consequences of continued non-payment, including potential legal action. To increase urgency, the letter sets a specific deadline for payment, usually around 14 days for businesses.

Depending on the jurisdiction, we may also highlight applicable laws. For instance, in the UK, the Late Payment of Commercial Debts (Interest) Act 1998 allows businesses to claim significant interest (8% above the Bank of England base rate) plus fixed compensation costs. Mentioning this isn't meant to scare—it's simply a reminder that legal frameworks support you in recovering what's owed.

Often, a carefully drafted formal demand letter is enough to prompt payment. After all, most businesses prefer to avoid legal fees, hassle, and potential damage to their reputation.

Legal Proceedings and Enforcement

Sometimes, despite your best efforts, a debtor refuses to cooperate. If amicable negotiations and formal demands don't work, it's time to consider legal proceedings.

At Cosmopolite, we always advise clients to carefully consider this step. One debt recovery expert puts it best: "A word of warning: if a debtor is genuinely unable to pay, you could be throwing good money after bad." This is why we carefully assess each debtor's situation before recommending a legal route.

If legal action is the right move, here's how the process typically goes:

First, we'll file a legal claim against the debtor. In the UK, this usually means filing through the County Court, which then formally issues the claim. The debtor typically has 14 days to respond.

Next, if the debtor doesn't respond or has no valid defense, the court grants a County Court Judgment (CCJ). This legal judgment formally acknowledges the debt.

With a judgment in place, we move to enforcement, using a variety of tools to collect what's owed. Depending on the situation, this might involve High Court Sheriffs or County Court Bailiffs physically seizing assets, placing charging orders against property, applying for attachment of earnings (taking repayments directly from wages), or even initiating insolvency proceedings.

Typically, legal proceedings take around 4-8 weeks (depending on your jurisdiction), and additional time may be needed for enforcement to secure your payment.

Legal action should always be a last resort. But when necessary, it's a powerful tool in your corporate debt recovery arsenal. At Cosmopolite Debt Collection Agency, our expertise ensures you make smart, strategic choices to recover what's owed—without unnecessary cost or stress.

For more details, check out our comprehensive guide on Commercial Debt Collection.

Effective Strategies for Managing Corporate Debt Recovery

When you're dealing with overdue payments, it can feel like walking a tightrope. On one side, you're trying to get what's owed to you quickly; on the other, you're hoping to protect valuable business relationships. The good news? Effective corporate debt recovery isn’t just about tough tactics—it's also about smart strategies that solve problems without burning bridges.

Let's explore some proven approaches that help you recover unpaid debts successfully, efficiently, and with minimal stress.

Negotiation and Mediation

If you're facing overdue invoices, the first step is always to keep things friendly. While it might feel good (briefly!) to make demands, starting with an amicable conversation is usually much more effective. After all, businesses run into financial problems from time to time—it happens to the best of us.

Begin by opening an honest dialogue with your debtor. Sometimes a late payment is simply a misunderstanding or a temporary cash flow issue. Understanding the root of the problem is key to finding a workable solution.

Offering flexible payment plans can be especially helpful. For instance, if your debtor is experiencing temporary financial strain, agreeing on smaller, manageable installments rather than demanding immediate full payment can significantly increase your chances of recovering the full amount owed.

If payment plans don't quite fit the situation, you might explore a settlement offer. Accepting a slightly reduced amount right away could be better than waiting months or spending resources on lengthy legal battles.

And if conversations get stuck? That's when mediation can step in. Bringing in a neutral third party to facilitate discussions can smooth out disputes and help both sides reach an agreement. At Cosmopolite Debt Collection Agency, we've found that a respectful, collaborative approach resolves around 65% of cases without needing legal measures.

Our client, Suresh Nair, summed it up best: "They did a fantastic job recovering debt we had planned on writing off. The process was incredibly straightforward and professionally managed throughout."

Utilizing Professional Debt Recovery Services

When things become tricky or time-consuming, it can make good business sense to bring in the professionals. Turning to a reputable debt recovery specialist like Cosmopolite can save you headaches, time, and—most importantly—money.

Why consider outsourcing? Debt recovery professionals bring specialized expertise that your internal team may not have. They know exactly how to steer complicated regulations, legal frameworks, and negotiation methods to get you paid swiftly and compliantly.

Professional agencies also offer higher success rates. Industry leaders like The Kaplan Group boast an impressive 85% success rate on large, viable claims. Most internal collections teams simply can't match that.

Plus, professional debt recovery is usually a cost-effective choice. Many providers—including Cosmopolite—operate on a contingency basis. That means if they don't recover your debt, you don't pay. It's a true win-win scenario.

Another big plus: choosing a professional agency significantly reduces compliance risk. Debt recovery specialists stay up-to-date on regulations, providing peace of mind that your business won't accidentally trip over legal problems.

Finally, professional agencies like Cosmopolite offer truly global reach. Operating across 17 locations around the globe—including Miami, London, Paris, Madrid, Istanbul, Bangkok, Dubai, and all over Europe and North America—we understand local laws, languages, and cultural nuances. Whether your debtor is down the street or across an ocean, our experienced team can help.

One of our clients, Neil Parekh, shared his experience: "When retaining a collection agency, I had high expectations for collecting our old accounts receivable, and their collections results have been very positive. I highly recommend them."

At Cosmopolite Debt Collection Agency, we combine compassionate negotiation with firm, professional action. We help you recover debts effectively, ensuring you maintain healthy business relationships while getting paid what's rightfully yours.

For more tips on recovering debts smoothly, check out our guide on Effective Debt Recovery Strategies. For additional industry insights, the Commercial Collection Agency Association provides valuable resources on commercial debt recovery best practices.

Remember: with the right approach and professional guidance, corporate debt recovery becomes less about confrontation and more about collaboration.

Leveraging Technology in Corporate Debt Recovery

Remember when debt recovery meant mountains of paperwork, endless phone calls, and that sinking feeling when you couldn't find an important document? Those days are thankfully behind us. Today's corporate debt recovery landscape has been completely transformed by technology, bringing a breath of fresh air to what was once a tedious, manual process.

Automation Tools and Software

I've seen how the right software can turn chaos into clarity. Modern debt management platforms do far more than just send automatic reminders (though that alone is a game-changer). They create a digital home for your entire recovery process.

Think about how much easier life becomes when all your communications, payment histories, and documentation live in one accessible place. No more digging through filing cabinets or searching endless email threads to find that one crucial conversation from three months ago.

The beauty of these systems is in their consistency. When a payment is seven days late, the system knows exactly what to do—perhaps sending a gentle reminder email. At 14 days, maybe it's time for a phone call alert to your team. This systematic approach ensures nothing falls through the cracks, which happens all too often with manual processes.

At Cosmopolite, we developed our own system called AEREN Collect™ precisely because we understand how important visibility is for our clients. There's something incredibly reassuring about logging in and seeing exactly where your case stands, rather than wondering if anyone's working on it at all.

As one of our clients recently told me, "It's like having a window into the recovery process. I can check progress anytime without having to make a call or send an email asking for updates."

The integration with accounting systems is perhaps the most underrated feature of modern debt recovery software. When your collection efforts automatically sync with your financial records, you eliminate double-entry and ensure everyone in your organization works with the same, accurate information.

Data Analytics and Tracking

Beyond just organizing information, today's technology helps us make sense of it. This is where corporate debt recovery truly becomes strategic rather than merely reactive.

Data analytics transforms raw information into actionable insights. Instead of treating all overdue accounts the same way, you can identify patterns that help you prioritize your efforts.

For example, imagine being able to spot a client who consistently pays exactly 45 days late. That's different from a client who suddenly stops paying after years of prompt payments—which might indicate financial trouble. These insights allow you to tailor your approach accordingly.

Predictive analytics takes this even further. By analyzing historical data, these tools can actually forecast which accounts are likely to become problematic before they miss a payment. This gives you the opportunity to proactively reach out, perhaps offering flexible payment options before the situation deteriorates.

The resource allocation aspect is particularly valuable for businesses with large numbers of outstanding invoices. Rather than spreading efforts evenly across all accounts, analytics helps you focus on the ones with the highest probability of recovery.

One of the most challenging aspects of debt recovery has always been assessing whether a debtor can actually pay. Modern data tools provide crucial insights into a company's financial health, helping you decide whether to pursue payment aggressively or perhaps consider a settlement.

At Cosmopolite, our technology-improved approach is a major reason why our recovery rates exceed industry averages by 30%. But we never forget that technology is just a tool—it's the human expertise behind it that makes the real difference. That's why we maintain a 4.52/5 satisfaction rating from over 16,827 reviews.

The right blend of cutting-edge technology and human judgment creates a debt recovery process that's not just more efficient, but also more successful and less stressful for everyone involved. After all, the goal isn't just to collect what's owed—it's to do so while preserving relationships and your business reputation whenever possible.

For more information about how technology can improve your debt recovery processes, check out our article on Effective Debt Recovery Strategies.

Maintaining Client Relationships During Debt Recovery

Let's face it—talking about money owed can feel pretty awkward. Yet keeping those client relationships strong is critical, even when you're navigating the tricky waters of corporate debt recovery. Here's the good news: handled professionally and respectfully, the debt recovery process can actually strengthen your relationships rather than harm them. At Cosmopolite, we see it happen all the time—so trust me, it's possible!

Balancing Corporate Debt Recovery with Customer Retention

When you're chasing overdue payments, it's natural to feel frustration—but remember, your debtor is often in a tough spot too. Keeping the dialogue respectful, clear, and professional goes a long way in preserving goodwill. Our best advice? Always separate the debt from the relationship. Make it clear this is purely a business matter, nothing personal.

Actively listening to your client's situation is also vital. Sometimes, understanding their challenges opens up opportunities to find creative solutions that work for everyone. Rather than making demands, try offering practical suggestions—like setting up reasonable payment plans or negotiating alternative settlement options. Showing empathy builds trust, and trust keeps relationships strong.

And don't underestimate the power of excellent record-keeping. Clearly documenting each step protects both parties from misunderstandings and maintains transparency. As another debt collection agency states, "Emphasizing diplomatic and tactful communication in debt collection can help improve cash flow while preserving customer relationships." We couldn't agree more.

At Cosmopolite, our friendly yet firm approach to corporate debt recovery ensures that 72% of debtors continue doing business with our clients after the recovery process—far above the industry average of just 40%. Who knew debt recovery could lead to long-term loyalty?

When to Consider Writing Off a Debt

Now let's be honest—sometimes it just makes sense to let a debt go. After all, some battles aren't worth fighting, especially if the costs outweigh the potential recovery. For instance, chasing a €500 payment isn't smart business if it costs you almost as much in your time and resources. As one expert wisely advises, "Sometimes it's better to write off small amounts."

You should also consider the bigger picture. If a valued client is genuinely unable to pay due to insolvency, continuing collection efforts could waste valuable resources. Likewise, if a usually reliable customer faces temporary troubles, your long-term relationship might be more valuable than immediate cash recovery. Finally, if legal recovery seems unlikely due to jurisdictional issues or protected assets, it may be wiser to cut your losses.

Wondering if a debt should be written off or pursued? Don't stress—we can help. At Cosmopolite, we offer free assessments to determine whether debts are worth pursuing. No guesswork, just solid guidance to protect your bottom line and maintain healthy client relationships.

Amicable Recovery vs. Legal Proceedings

When it comes to corporate debt recovery, businesses essentially have two paths forward: the handshake or the gavel. Both approaches have their place in the debt recovery toolkit, but knowing which one to use—and when—can make all the difference between getting paid and writing off a loss.

Understanding Amicable Recovery

Think of amicable recovery as the diplomatic approach to collecting what you're owed. It's about working together with your debtor to find a solution that works for everyone—without judges, courts, or legal fees entering the picture.

Amicable recovery starts with a friendly reminder about the outstanding payment. You know the type: "Just checking in about invoice #12345..." These initial communications set a cooperative tone rather than an adversarial one. From there, the process typically evolves into a conversation about why the payment is delayed and what can be done to resolve it.

"Amicable Recovery is a consensual and cooperative debt collection method that aims to settle outstanding payments without resorting to judicial measures," explains one debt recovery expert. "This process often commences with a courteous reminder, followed by mutually beneficial negotiations, in an effort to secure payment."

The beauty of amicable recovery lies in its efficiency and relationship preservation. Resolving a debt this way typically takes weeks rather than the months or years legal proceedings might require. Plus, you're much more likely to keep that business relationship intact—something that's particularly valuable if the debtor is otherwise a good customer who's just experiencing temporary difficulties.

At Cosmopolite, we've found that these consensual approaches often lead to creative solutions like structured payment plans that give debtors breathing room while ensuring you eventually receive what you're owed. Sometimes, a settlement offer accepting a reduced amount in exchange for immediate payment makes financial sense for both parties.

Choosing the Right Corporate Debt Recovery Method

So how do you decide whether to extend an olive branch or serve papers? Several factors should guide this decision:

First, consider the debtor's attitude. Are they answering your calls and acknowledging the debt, or have they gone radio silent? If they're still communicating, amicable recovery has a strong chance of success. On the flip side, as one collection professional puts it: "If a customer is ignoring phone calls, letters, faxes, and emails, they will likely not pay without turning to a collections agency and/or a debt collection attorney."

The age of the debt matters tremendously. Fresh debts are much easier to recover through friendly means. "The sooner you identify a debt and alert your collection agency, the quicker it can be resolved," notes an industry expert. Once a debt has been lingering for months, debtors tend to prioritize newer obligations over your aging invoice.

You'll also want to assess whether your debtor can actually pay. If they have the means but are simply choosing not to, the pressure of legal proceedings might be necessary to motivate payment. However, if they're genuinely struggling financially, legal action might just add costs to an already uncollectible debt.

Don't forget to weigh the relationship value against the debt amount. Is this a one-time customer, or someone who provides regular business? Sometimes preserving a relationship with a valuable client outweighs the immediate benefit of aggressive collection tactics.

Finally, there's the simple matter of cost. Legal proceedings involve court fees, attorney costs, and significant time investments. If these expenses might exceed the debt value, amicable recovery is clearly the more sensible approach.

At Cosmopolite Debt Collection Agency, our experience shows that corporate debt recovery is most successful when it follows a progressive approach. We typically begin with amicable methods, reserving legal proceedings for when diplomatic options have been exhausted. Our data speaks for itself: 78% of our successfully recovered debts are resolved through amicable means, saving our clients the costs and headaches associated with litigation.

That said, we don't hesitate to recommend legal action when it's truly the best option. Sometimes a firm legal approach is exactly what's needed, particularly when dealing with debtors who are deliberately avoiding their obligations or acting in bad faith.

For more detailed information about the collection process between businesses, check out What is B2B Debt Collection, where we explore these approaches in greater depth.

International Corporate Debt Recovery

When your business extends beyond borders, so do your debt recovery challenges. Collecting from international clients adds layers of complexity that can feel overwhelming—different legal systems, language barriers, and cultural nuances all come into play.

At Cosmopolite, we see these challenges daily across our 17 global locations. From our offices in Miami, Paris, London, Madrid, Istanbul, Bangkok, Dubai, and throughout Europe and North America, we've learned that corporate debt recovery across borders requires both local knowledge and global expertise.

Navigating Legal Systems Abroad

The first hurdle in international corporate debt recovery is determining which country's laws apply to your situation. This isn't always straightforward—a contract signed in Germany with a company headquartered in Spain for services delivered in France creates a complex jurisdictional puzzle.

Each country approaches debt collection differently. While the UK gives you six years to pursue a commercial debt, other countries may offer more or less time. Some legal systems move quickly, while others might test your patience with lengthy proceedings.

Documentation requirements vary widely too. What works in one country might be dismissed in another, and formal notices often need professional translation to be legally valid. Even the way courts interpret contracts can differ dramatically between countries.

Perhaps most frustrating is that winning a judgment doesn't guarantee payment. As one of our clients finded after winning a case against a French debtor, enforcing that judgment required additional steps through French courts—a process we guided them through using our local expertise.

"The paperwork seemed endless," shared a client who tried handling international collection alone before coming to us. "What I thought would be a simple matter turned into a six-month ordeal until Cosmopolite stepped in."

Cross-border Debt Recovery Strategies

Success in international corporate debt recovery comes down to working with people who understand both sides of the equation. Our approach combines global reach with local insight—we don't just know the laws, we understand the business cultures.

Cultural sensitivity matters more than many realize. In some countries, aggressive collection tactics that might work in the US or UK could permanently damage relationships and reduce your chances of recovery. In others, being too gentle might be interpreted as lack of seriousness.

Communication in the debtor's language makes a significant difference too. Beyond the practical benefits, it demonstrates respect and often opens doors that remain closed to those who insist on communicating only in English.

International enforcement treaties can be powerful tools when used correctly. For example, the New York Convention helps enforce arbitration awards across borders, often providing a more direct path than navigating multiple court systems.

When Varun Singh came to us after trying for four years to collect an international debt, we applied these principles with remarkable results. "Thank you for all your efforts and very professional processes," he told us afterward. "It is refreshing to see our dues finally getting cleared after 4 years, and I would recommend this service to anyone in need."

A recent success story highlights our approach in action: A Portuguese recruitment company had outstanding invoices from clients in the UK, Portugal, and Germany. By leveraging our local teams in each country—each familiar with local business practices and legal systems—we recovered 80% of the outstanding amount within three months.

International corporate debt recovery doesn't have to be a nightmare. With the right partner who understands both the global picture and local details, even your most challenging cross-border debts can be transformed from write-offs into recovered revenue.

Frequently Asked Questions about Corporate Debt Recovery

How Long Can a Business Legally Pursue a Debt?

One of the most common questions businesses have when it comes to corporate debt recovery is about how long a debt remains legally collectible. The truth is, the answer depends on where the debt was created and the jurisdiction involved.

For example, in the UK, businesses typically have six years to pursue a commercial debt, counting from the last date of payment or written acknowledgment. In the US, this timeframe varies significantly from state to state, generally ranging from 3 to 10 years for written contracts. Meanwhile, in European Union countries, statutes of limitations typically span anywhere from 3 years up to a decade, depending on the country in question.

It's also worth noting that this timeline can be extended or "reset" if the debtor makes even a small payment or provides written acknowledgment of the debt. Additionally, once you successfully obtain a court judgment, the time allowed to enforce the judgment can be much longer than the initial limitation period.

At Cosmopolite Debt Collection Agency, we always advise our clients to act sooner rather than later. Early intervention can drastically improve your chances of successful debt recovery—so there's no reason to wait until you're bumping against the statute of limitations.

What Are the Risks of Pursuing Legal Action for Debt Recovery?

While taking legal action can seem like the straightforward step when amicable methods fail, it's important to understand that litigation carries its own set of risks and complications.

First and foremost, legal proceedings involve financial costs—court fees, lawyer charges, enforcement expenses—which can quickly add up. There's also the time investment factor: court processes aren't known for their speed, and corporate debt recovery cases can sometimes drag on for months or even years.

Another significant risk is the potential for relationship damage. Going to court can strain or even permanently sever business ties, something you certainly want to avoid if the customer relationship has future value.

Even after successfully obtaining a judgment, recovery uncertainty remains. If the debtor lacks sufficient assets or declares bankruptcy, you might win your case legally but still fail to recover the actual money owed. Additionally, businesses taking legal action might face unexpected counterclaims from debtors, alleging issues with the products or services provided.

At Cosmopolite Debt Collection Agency, we understand these risks intimately. That's why we conduct thorough assessments to ensure pursuing legal action makes practical sense. After all, as we often say: If the debtor truly can't pay, you don't want to throw good money after bad.

How Can Technology Improve Debt Recovery Processes?

Technology isn't just helpful—efficient and successful corporate debt recovery. Modern technology tools can transform what used to be a slow, stressful administrative task into a quick, streamlined process.

One of the most helpful aspects of modern technology is automation. Tools and software can automatically send reminders, follow-up notices, and escalations. This saves your team valuable time and ensures that no debt is accidentally forgotten or overlooked.

Another major benefit is real-time tracking. Today's debt management solutions provide instant updates and allow creditors to monitor each case's progress, debtor responses, and payment status quickly and easily. This transparency provides peace of mind, knowing exactly what's happening with every debt case at any given moment.

But perhaps the most exciting development is the use of data analytics. By analyzing debtor behavior patterns, payment histories, and other insights, you can proactively identify risks and optimize your debt recovery strategies. With this information, you'll know exactly where to focus your time and resources to achieve the best outcomes.

Additionally, modern platforms offer easy-to-use digital communication channels like email, SMS, and online portals, helping you communicate effectively and efficiently with debtors. This also ensures you always have documented evidence of your communication history.

Finally, seamless integration with accounting systems ensures your financial records stay accurate and up-to-date, minimizing manual data entry and preventing costly errors or inconsistencies.

At Cosmopolite Debt Collection Agency, we've seen the power of technology firsthand. Our proprietary debt management software provides a secure, user-friendly portal where clients can access detailed real-time information on each case. Thanks to tech-driven transparency and efficiency, we've maintained an exceptional client satisfaction score of 4.52/5 from over 16,827 client reviews.

As one technology provider humorously yet accurately states: "Who knew debt recovery could be this smooth? Thanks, automation!"

Conclusion

Navigating corporate debt recovery can feel like a balancing act—part art, part science, and a dash of diplomacy. At the end of the day, it's not just about reclaiming what's owed; it's about safeguarding your company's financial health, keeping your relationships intact, and maintaining your sanity (trust me, we've all been there!).

Throughout this guide, we've walked together through every crucial step—from sending those polite-but-firm reminders to gracefully handling tricky international debt situations. We've explored when negotiation and mediation can save relationships, how professional debt recovery services like Cosmopolite Debt Collection Agency can step in to relieve your burden, and why technology is your best friend in streamlining the entire process.

If there's one thing I'd love for you to take away, it's that taking action early truly matters. Prompt communication and clearly documented interactions not only boost your chances of recovering what's owed but also show your clients you're serious, professional, and fair. A flexible yet firm approach can turn even challenging situations around, protecting your business's reputation while keeping cash flowing.

Of course, not every debt can—or should—be recovered. Knowing exactly when to escalate to legal proceedings or when to gracefully write off a debt is part of the wisdom you gain along the journey. A strategic approach helps you minimize wasted energy and resources, so you can focus on the debts truly worth pursuing.

At Cosmopolite, we've spent years refining these strategies across thousands of debts in over 17 countries—from Miami and Paris to Bangkok, Dubai, and beyond. Our unique blend of professional negotiation combined with legal action (when needed) helps businesses like yours recover unpaid receivables efficiently and cost-effectively.

We believe that debt recovery isn't just about reclaiming lost revenue; it's about turning potentially stressful situations into opportunities for clearer communication and stronger relationships. After all, 72% of debtors continue doing business with our clients after we've resolved their debt—that’s something we're genuinely proud of!

In short, corporate debt recovery is about more than just cash—it's about clarity, respect, and mutual understanding. With the right strategies, professional guidance, and a dash of patience, you can turn unpaid invoices into revenue without losing sleep (or your sanity).

If you're navigating corporate debt recovery challenges, you don't have to go it alone. Our friendly, highly-rated team (4.52/5 from over 16,827 reviews—yep, we're proud of that too!) is here to help.

For more details or to chat about your specific needs, reach out to us at Cosmopolite Debt Collection Agency. We're always ready to help businesses like yours reclaim what's owed—without losing your cool in the process!